2017 China Biopharmaceutical and Biotechnology Industry Investment White Paper: Transition from Extensive Volume Growth to Intensive Quality Enhancement

2017-05-12 0

Background and Outlook: The Past Decade and the Eve of Qualitative Change

In October 2016, the State Council promulgated the "Healthy China 2030" Planning Outline (hereinafter referred to as the "Outline"), and the concept of "Healthy China" was elevated to a strategic position of priority development. The "Outline" clearly stated that the total scale of the health service industry will exceed 8 trillion and 16 trillion in 2020 and 2030, and the "Healthy China" strategy will surely become an important engine for the development of my country's medical and health industry.

Before talking about the next decade, let's take a brief look back at the past decade.

In the first five years from 2007 to 2011, the Chinese government continued to increase medical and health expenditures, especially the new round of medical reform launched in 2009, which added nearly 1 trillion yuan to expand the coverage of the medical insurance system and establish a basic drug system, which greatly boosted the industry's prosperity; at the same time, the expansion of urban employee and urban resident medical insurance brought rapid growth to the industry.

In the last five years from 2011 to 2015, after experiencing a major expansion of national medical insurance, some regions began to face payment pressure for medical insurance funds, and medical reform entered a deep water zone. Local governments began to explore different ways of medical insurance cost control measures. The policy hand began to intervene strongly, and the tightening of terminal payments slowed down the release of "rigid" medical demand.

Since 2015, medical insurance cost control has begun to show initial results. The urban basic medical insurance fund showed that income was greater than expenditure in both 2015 and 2016, and the growth rate of income exceeded the growth rate of expenditure. At the same time, commercial health insurance is also becoming a new payer for medicine and health. Although the sustainability pressure of medical insurance funds in many regions across the country is still increasing, under the background of a sharp increase in the market capacity of the entire medical and health industry and an overall improvement in multi-level payment capabilities, various new policies in the medical and health industry have already had a real foundation for implementation. In the next 5-10 years, we will usher in a real qualitative change in the reform of China's medical and health industry.

These qualitative changes include:

"Made in China" will rise strongly on the global new drug stage. According to Pharmaprojects statistics, by the end of 2015, there were 147 Chinese companies involved in original research and development. If we only look at the number of R&D companies, China has replaced Japan as the largest new drug R&D country in Asia. With the introduction of the priority review policy of China's CFDA (State Food and Drug Administration) and the substantial expansion of reviewers at the CDE (Center for Drug Evaluation), China's new drug review concepts and working methods are increasingly in line with international standards. At the same time, with the return of a large number of talents with many years of work experience in international multinational pharmaceutical giants, China's pharmaceutical industry has comprehensively improved in basic scientific research, laboratory research and development, process and production, quality control and other aspects. As far as we know, there are currently more than 10 new drug R&D companies in China that are leading the world and have entered or completed Phase III clinical trials, and more than 50 have entered Phase I and Phase II clinical trials. It can be expected that as these companies grow and mature, a group of innovative and original drug companies with world-leading technologies will emerge in China in the pharmaceutical field and bring their blockbuster new products to the global market.

China has the opportunity to lead the world in precision medicine. In the field of upstream sequencing instruments, American companies have an absolute advantage, but the core of precision medicine research requires a large amount of data collection and analysis, and China has a clear advantage in this regard. Among the hundreds of Chinese companies engaged in gene sequencing services, BGI is already the world's leading NIPT company; in the most promising CAR-T industry for the treatment of blood tumors, China's number of clinical trials is second only to the United States, ranking in the first echelon of the global CAR-T field. Precision medicine represents the development direction of human medical health in the future, and China will also have the opportunity to take a leading position in the world in the field of precision medicine.

Wearable devices + remote diagnosis and treatment + artificial intelligence will completely subvert traditional diagnosis and treatment services. Not long ago, IBM's supercomputer Watson digested and absorbed 25,000 medical cases, ended its two-year "seclusion", and traveled thousands of miles to China, opening the curtain of artificial intelligence application in China's medical field at Zhejiang Provincial Hospital of Traditional Chinese Medicine. The biggest pain point of China's medical service system is the contradiction between supply and demand of scarce medical resources, but with the popularization of Internet hospitals, medical wearable devices and third-party imaging centers, artificial intelligence will play a greater role in disease prevention and diagnosis and treatment in the future. Technological breakthroughs and the rapid development of artificial intelligence have made us increasingly clear about the possibility of subversion of the traditional medical service model.

Against this backdrop, we believe that on the eve of qualitative change, the following areas are worthy of attention from investors in the primary market of the health sector in 2017-2018:

· Reshuffle of the generic drug industry brought about by consistency evaluation

· Changes in review efficiency and concepts promote the development of Chinese new drug research and development companies

· Development of domestic biopharmaceuticals, innovative drugs and precision treatment

· Integration of the commercial field under the two-invoice system

· Import substitution of high-end medical devices

· Cross-border acquisition of high-end medical devices

· Application of AI and robots in the field of medical health

· Accelerated development of hierarchical diagnosis and treatment and specialized chain medical service platforms

Medicine and biotechnology fields

Industry trends

In 2016, the terminal drug market size of the pharmaceutical industry was 147.74 billion yuan, and the growth rate has slowed down to 7.3%. Under the circumstances of medical insurance cost control and various industry policies for hospitals becoming stricter, the growth rate of the pharmaceutical industry has further slowed down. It can be expected that the future industry growth rate will be basically close to the GDP growth rate. The industry trend in the future will be mainly structural adjustment. The pharmaceutical industry will gradually evolve from extensive volume growth to refined quality improvement.

Data source: Southern Pharmaceutical Industry Economic Research Institute

In such a market environment, the driving force of growth is concentrated on the expansion of medical insurance coverage, the launch of new products, the continuous improvement and perfection of medical infrastructure and services, the rapid growth of chronic disease incidence, provincial/municipal-level high-value drug reimbursement and private investment in health care. The foreseeable challenges and market pressures are mainly reflected in stricter overall control of medical insurance, severe bidding forms, quality consistency evaluation, rational use of drugs, reduced drug share and implementation of national price negotiations for patented drugs.

From the perspective of national policies: the consistency evaluation of generic drug quality and efficacy (hereinafter referred to as "consistency evaluation"), "two-invoice system + business tax to value-added tax" and the new version of the medical insurance catalog are the three most important policies for predicting future trends. The consistency evaluation related policies have been issued intensively, clarifying the scope of drugs that need to complete the consistency evaluation and determining the time limit. The wait-and-see and confusion of pharmaceutical companies will quickly turn into a rush to compete; the two-invoice system is clearly defined, and 11 comprehensive medical reform pilot provinces and 200 pilot cities will take the lead in implementing it, and strive to fully roll it out nationwide by 2018. At the same time, the bill management must be strictly implemented. When the drugs are inspected and put into the warehouse, the bill, goods and accounts must be consistent. Townships (towns) can add one more bill. The effect of the "two-invoice system + business tax reform" is released at a uniform rate, and the pharmaceutical business is facing a substantial structural adjustment; the new version of the medical insurance catalog contains a total of 2,535 drugs, an increase of 15.4%, of which 1,297 are Western medicines, an increase of about 11.4%, 402 are Class A Western medicines, 895 are Class B, and there are 1,238 Chinese medicines, an increase of about 20%, of which 43 are ethnic medicines, 192 are Class A Chinese medicines, and 1,046 are Class B. The changes brought about by the new version of the medical insurance catalog will be seen in a year.

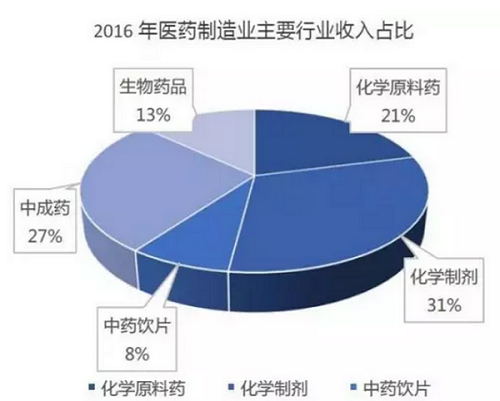

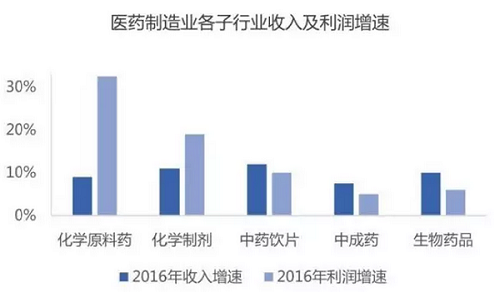

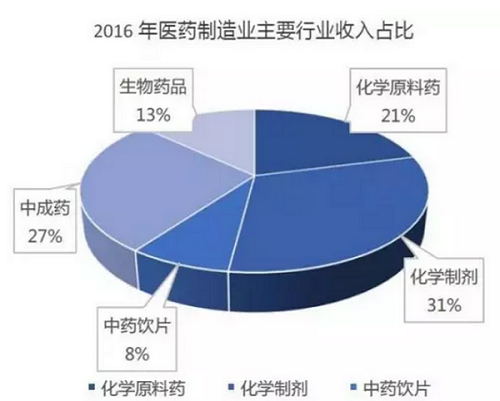

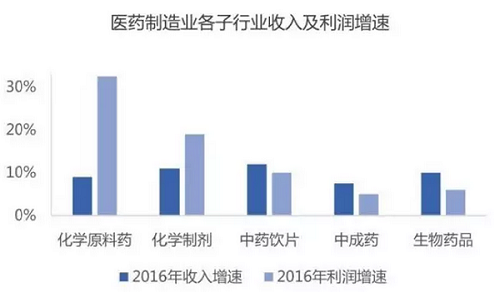

From the perspective of sub-sectors: Since 2015, affected by the rising prices of bulk APIs, chemical preparations are still the leader of the pharmaceutical manufacturing industry, and their performance has gradually improved. In 2016, the scale of the sub-sector was 753.47 billion yuan, an increase of 10.8% year-on-year, and the total profit was 95.05 billion yuan, an increase of 16.8% year-on-year. With the advancement of the policy of consistency evaluation of generic drugs, it will inevitably promote the upgrading and structural adjustment of my country's pharmaceutical industry. In the future, the chemical preparation industry will show a trend of survival of the fittest and increased concentration. Biopharmaceuticals are still growing rapidly, but the profit growth rate has declined. It is expected that there will still be a large room for release in the future. The traditional Chinese medicine industry enjoys policy support. It is expected that the liberalization of production, clinical application, medical insurance and other policies in the future will promote the rapid growth of the traditional Chinese medicine formula granule industry, while the traditional Chinese medicine slice industry will still maintain a relatively fast growth. The recovery of the API industry since 2015 may reach its peak in the next two years, and there are short-term investment opportunities. Domestic new drug research and development is in the ascendant, and platform-type new drug research and development companies that face the Chinese and even global markets and master blockbuster products and key technologies will be favored by capital. Targeted drugs guided by the concept of precision medicine have high capital costs and R&D risks. Domestic pharmaceutical companies tend to obtain exclusive authorization from foreign companies or select blockbuster drugs to be developed and marketed domestically. New dosage forms of small molecule drugs and new varieties of biological drugs will become a trend.

Data source: Southern Pharmaceutical Industry Economic Research Institute

Data source: Southern Pharmaceutical Industry Economic Research Institute

Looking ahead to the next three years, we expect the following changes to occur in China's pharmaceutical and biotechnology industries.

1. Consistency evaluation brings structural changes to the generic drug market

The fundamental purpose of the consistency evaluation of generic drug quality and efficacy is to improve the quality level of domestic generic drugs and ultimately achieve import substitution and medical insurance cost control. Although consistency evaluation will reshape the generic drug industry and bring investment opportunities, this issue needs to be viewed dialectically.

Consistency evaluation does not necessarily lead to an increase in the domestic generic drug market share in the short term, nor does it mean a reduction in medical expenses in the short term. During the structural adjustment period, the bioequivalence and process level, channel brand, and price reduction space of the varieties involved in the consistency evaluation are the criteria for judging investment value in the reshuffle of the generic drug industry. On the one hand, for products that are difficult to meet the standards for bioequivalence and process level, the process level is the standard for judging whether they have investment value. For products that are easy to meet the standards for bioequivalence and process level, the market is fully competitive, and at this time, channels and brands are the standards for judging investment value. On the other hand, for a generic drug that is about to be launched or has just been launched, the key to its investment value lies in how much room there is for price reduction for the original research product. This price reduction space should be considered in absolute terms rather than percentages. Among the companies that have met the standards, those whose main products must complete the consistency evaluation of generic drugs by the end of 2018 and have applied for consistency evaluation are particularly worthy of attention.

The shortage of clinical institutions qualified to complete the consistency evaluation, the lack of industry standards, and the shortage of reference preparations are likely to affect the completion of the consistency evaluation as scheduled before the end of 2018, and policy adjustments may be inevitable. The 289-product catalog proposed for the consistency evaluation is only the first step, and the subsequent introduction of a wider range of consistency evaluation policies may have a more far-reaching impact on the industry. Although there are uncertainties, the role of consistency evaluation in promoting leading generic drug companies, CRO companies, leading pharmaceutical excipient companies and pharmaceutical export companies in the short term is undoubted.

2. The "two-invoice system" has greatly compressed the pharmaceutical circulation link and increased the concentration of pharmaceutical business

With the introduction and implementation of the "two-invoice system" and "business tax to value-added tax", companies are forced to switch from the past "low opening" model to the "high opening" model, and the financial and tax burden of companies has increased significantly. Small and medium-sized wholesale companies that integrate agency, ticketing and distribution are facing elimination due to the unsustainable ticketing business and the pressure of medical institutions to collect payments. They are urgently seeking acquisitions from large-scale distribution companies, and the circulation link will be greatly compressed. National and regional distribution leading companies have greatly expanded their terminal coverage through mergers and acquisitions.

At the same time, under the pressure of the "two-invoice system", small chain drugstores and retail stores will face large-scale integration due to the increase in operating costs and decline in profits caused by the inability to use cash transactions. Large chain drugstores will continue to benefit from the increase in industry concentration. At the same time, emerging professional CSOs will grow rapidly in the future and become a sub-segment worthy of attention in the pharmaceutical business.

3. The new version of the medical insurance catalog brings short-term adjustments to the industry structure

The 2009 version of the medical insurance catalog gave birth to dozens of varieties with sales of over 1 billion. The birth of the new version of the medical insurance catalog means that the 1.5 trillion pharmaceutical market is expected to usher in reconstruction.

In 2017, the new version of the medical insurance catalog added 339 drugs, including 17 new varieties in the central nervous system field and 21 new varieties.

Background and Outlook: The Past Decade and the Eve of Qualitative Change

In October 2016, the State Council promulgated the "Healthy China 2030" Planning Outline (hereinafter referred to as the "Outline"), and the concept of "Healthy China" was elevated to a strategic position of priority development. The "Outline" clearly stated that the total scale of the health service industry will exceed 8 trillion and 16 trillion in 2020 and 2030, and the "Healthy China" strategy will surely become an important engine for the development of my country's medical and health industry.

Before talking about the next decade, let's take a brief look back at the past decade.

In the first five years from 2007 to 2011, the Chinese government continued to increase medical and health expenditures, especially the new round of medical reform launched in 2009, which added nearly 1 trillion yuan to expand the coverage of the medical insurance system and establish a basic drug system, which greatly boosted the industry's prosperity; at the same time, the expansion of urban employee and urban resident medical insurance brought rapid growth to the industry.

In the last five years from 2011 to 2015, after experiencing a major expansion of national medical insurance, some regions began to face payment pressure for medical insurance funds, and medical reform entered a deep water zone. Local governments began to explore different ways of medical insurance cost control measures. The policy hand began to intervene strongly, and the tightening of terminal payments slowed down the release of "rigid" medical demand.

Since 2015, medical insurance cost control has begun to show initial results. The urban basic medical insurance fund showed that income was greater than expenditure in both 2015 and 2016, and the growth rate of income exceeded the growth rate of expenditure. At the same time, commercial health insurance is also becoming a new payer for medicine and health. Although the sustainability pressure of medical insurance funds in many regions across the country is still increasing, under the background of a sharp increase in the market capacity of the entire medical and health industry and an overall improvement in multi-level payment capabilities, various new policies in the medical and health industry have already had a real foundation for implementation. In the next 5-10 years, we will usher in a real qualitative change in the reform of China's medical and health industry.

These qualitative changes include:

"Made in China" will rise strongly on the global new drug stage. According to Pharmaprojects statistics, by the end of 2015, there were 147 Chinese companies involved in original research and development. If we only look at the number of R&D companies, China has replaced Japan as the largest new drug R&D country in Asia. With the introduction of the priority review policy of China's CFDA (State Food and Drug Administration) and the substantial expansion of reviewers at the CDE (Center for Drug Evaluation), China's new drug review concepts and working methods are increasingly in line with international standards. At the same time, with the return of a large number of talents with many years of work experience in international multinational pharmaceutical giants, China's pharmaceutical industry has comprehensively improved in basic scientific research, laboratory research and development, process and production, quality control and other aspects. As far as we know, there are currently more than 10 new drug R&D companies in China that are leading the world and have entered or completed Phase III clinical trials, and more than 50 have entered Phase I and Phase II clinical trials. It can be expected that as these companies grow and mature, a group of innovative and original drug companies with world-leading technologies will emerge in China in the pharmaceutical field and bring their blockbuster new products to the global market.

China has the opportunity to lead the world in precision medicine. In the field of upstream sequencing instruments, American companies have an absolute advantage, but the core of precision medicine research requires a large amount of data collection and analysis, and China has a clear advantage in this regard. Among the hundreds of Chinese companies engaged in gene sequencing services, BGI is already the world's leading NIPT company; in the most promising CAR-T industry for the treatment of blood tumors, China's number of clinical trials is second only to the United States, ranking in the first echelon of the global CAR-T field. Precision medicine represents the development direction of human medical health in the future, and China will also have the opportunity to take a leading position in the world in the field of precision medicine.

Wearable devices + remote diagnosis and treatment + artificial intelligence will completely subvert traditional diagnosis and treatment services. Not long ago, IBM's supercomputer Watson digested and absorbed 25,000 medical cases, ended its two-year "seclusion", and traveled thousands of miles to China, opening the curtain of artificial intelligence application in China's medical field at Zhejiang Provincial Hospital of Traditional Chinese Medicine. The biggest pain point of China's medical service system is the contradiction between supply and demand of scarce medical resources, but with the popularization of Internet hospitals, medical wearable devices and third-party imaging centers, artificial intelligence will play a greater role in disease prevention and diagnosis and treatment in the future. Technological breakthroughs and the rapid development of artificial intelligence have made us increasingly clear about the possibility of subversion of the traditional medical service model.

Against this backdrop, we believe that on the eve of qualitative change, the following areas are worthy of attention from investors in the primary market of the health sector in 2017-2018:

· Reshuffle of the generic drug industry brought about by consistency evaluation

· Changes in review efficiency and concepts promote the development of Chinese new drug research and development companies

· Development of domestic biopharmaceuticals, innovative drugs and precision treatment

· Integration of the commercial field under the two-invoice system

· Import substitution of high-end medical devices

· Cross-border acquisition of high-end medical devices

· Application of AI and robots in the field of medical health

· Accelerated development of hierarchical diagnosis and treatment and specialized chain medical service platforms

Medicine and biotechnology fields

Industry trends

In 2016, the terminal drug market size of the pharmaceutical industry was 147.74 billion yuan, and the growth rate has slowed down to 7.3%. Under the circumstances of medical insurance cost control and various industry policies for hospitals becoming stricter, the growth rate of the pharmaceutical industry has further slowed down. It can be expected that the future industry growth rate will be basically close to the GDP growth rate. The industry trend in the future will be mainly structural adjustment. The pharmaceutical industry will gradually evolve from extensive volume growth to refined quality improvement.

Data source: Southern Pharmaceutical Industry Economic Research Institute

In such a market environment, the driving force of growth is concentrated on the expansion of medical insurance coverage, the launch of new products, the continuous improvement and perfection of medical infrastructure and services, the rapid growth of chronic disease incidence, provincial/municipal-level high-value drug reimbursement and private investment in health care. The foreseeable challenges and market pressures are mainly reflected in stricter overall control of medical insurance, severe bidding forms, quality consistency evaluation, rational use of drugs, reduced drug share and implementation of national price negotiations for patented drugs.

From the perspective of national policies: the consistency evaluation of generic drug quality and efficacy (hereinafter referred to as "consistency evaluation"), "two-invoice system + business tax to value-added tax" and the new version of the medical insurance catalog are the three most important policies for predicting future trends. The consistency evaluation related policies have been issued intensively, clarifying the scope of drugs that need to complete the consistency evaluation and determining the time limit. The wait-and-see and confusion of pharmaceutical companies will quickly turn into a rush to compete; the two-invoice system is clearly defined, and 11 comprehensive medical reform pilot provinces and 200 pilot cities will take the lead in implementing it, and strive to fully roll it out nationwide by 2018. At the same time, the bill management must be strictly implemented. When the drugs are inspected and put into the warehouse, the bill, goods and accounts must be consistent. Townships (towns) can add one more bill. The effect of the "two-invoice system + business tax reform" is released at a uniform rate, and the pharmaceutical business is facing a substantial structural adjustment; the new version of the medical insurance catalog contains a total of 2,535 drugs, an increase of 15.4%, of which 1,297 are Western medicines, an increase of about 11.4%, 402 are Class A Western medicines, 895 are Class B, and there are 1,238 Chinese medicines, an increase of about 20%, of which 43 are ethnic medicines, 192 are Class A Chinese medicines, and 1,046 are Class B. The changes brought about by the new version of the medical insurance catalog will be seen in a year.

From the perspective of sub-sectors: Since 2015, affected by the rising prices of bulk APIs, chemical preparations are still the leader of the pharmaceutical manufacturing industry, and their performance has gradually improved. In 2016, the scale of the sub-sector was 753.47 billion yuan, an increase of 10.8% year-on-year, and the total profit was 95.05 billion yuan, an increase of 16.8% year-on-year. With the advancement of the policy of consistency evaluation of generic drugs, it will inevitably promote the upgrading and structural adjustment of my country's pharmaceutical industry. In the future, the chemical preparation industry will show a trend of survival of the fittest and increased concentration. Biopharmaceuticals are still growing rapidly, but the profit growth rate has declined. It is expected that there will still be a large room for release in the future. The traditional Chinese medicine industry enjoys policy support. It is expected that the liberalization of production, clinical application, medical insurance and other policies in the future will promote the rapid growth of the traditional Chinese medicine formula granule industry, while the traditional Chinese medicine slice industry will still maintain a relatively fast growth. The recovery of the API industry since 2015 may reach its peak in the next two years, and there are short-term investment opportunities. Domestic new drug research and development is in the ascendant, and platform-type new drug research and development companies that face the Chinese and even global markets and master blockbuster products and key technologies will be favored by capital. Targeted drugs guided by the concept of precision medicine have high capital costs and R&D risks. Domestic pharmaceutical companies tend to obtain exclusive authorization from foreign companies or select blockbuster drugs to be developed and marketed domestically. New dosage forms of small molecule drugs and new varieties of biological drugs will become a trend.

Data source: Southern Pharmaceutical Industry Economic Research Institute

Data source: Southern Pharmaceutical Industry Economic Research Institute

Looking ahead to the next three years, we expect the following changes to occur in China's pharmaceutical and biotechnology industries.

1. Consistency evaluation brings structural changes to the generic drug market

The fundamental purpose of the consistency evaluation of generic drug quality and efficacy is to improve the quality level of domestic generic drugs and ultimately achieve import substitution and medical insurance cost control. Although consistency evaluation will reshape the generic drug industry and bring investment opportunities, this issue needs to be viewed dialectically.

Consistency evaluation does not necessarily lead to an increase in the domestic generic drug market share in the short term, nor does it mean a reduction in medical expenses in the short term. During the structural adjustment period, the bioequivalence and process level, channel brand, and price reduction space of the varieties involved in the consistency evaluation are the criteria for judging investment value in the reshuffle of the generic drug industry. On the one hand, for products that are difficult to meet the standards for bioequivalence and process level, the process level is the standard for judging whether they have investment value. For products that are easy to meet the standards for bioequivalence and process level, the market is fully competitive, and at this time, channels and brands are the standards for judging investment value. On the other hand, for a generic drug that is about to be launched or has just been launched, the key to its investment value lies in how much room there is for price reduction for the original research product. This price reduction space should be considered in absolute terms rather than percentages. Among the companies that have met the standards, those whose main products must complete the consistency evaluation of generic drugs by the end of 2018 and have applied for consistency evaluation are particularly worthy of attention.

The shortage of clinical institutions qualified to complete the consistency evaluation, the lack of industry standards, and the shortage of reference preparations are likely to affect the completion of the consistency evaluation as scheduled before the end of 2018, and policy adjustments may be inevitable. The 289-product catalog proposed for the consistency evaluation is only the first step, and the subsequent introduction of a wider range of consistency evaluation policies may have a more far-reaching impact on the industry. Although there are uncertainties, the role of consistency evaluation in promoting leading generic drug companies, CRO companies, leading pharmaceutical excipient companies and pharmaceutical export companies in the short term is undoubted.

2. The "two-invoice system" has greatly compressed the pharmaceutical circulation link and increased the concentration of pharmaceutical business

With the introduction and implementation of the "two-invoice system" and "business tax to value-added tax", companies are forced to switch from the past "low opening" model to the "high opening" model, and the financial and tax burden of companies has increased significantly. Small and medium-sized wholesale companies that integrate agency, ticketing and distribution are facing elimination due to the unsustainable ticketing business and the pressure of medical institutions to collect payments. They are urgently seeking acquisitions from large-scale distribution companies, and the circulation link will be greatly compressed. National and regional distribution leading companies have greatly expanded their terminal coverage through mergers and acquisitions.

At the same time, under the pressure of the "two-invoice system", small chain drugstores and retail stores will face large-scale integration due to the increase in operating costs and decline in profits caused by the inability to use cash transactions. Large chain drugstores will continue to benefit from the increase in industry concentration. At the same time, emerging professional CSOs will grow rapidly in the future and become a sub-segment worthy of attention in the pharmaceutical business.

3. The new version of the medical insurance catalog brings short-term adjustments to the industry structure

The 2009 version of the medical insurance catalog gave birth to dozens of varieties with sales of over 1 billion. The birth of the new version of the medical insurance catalog means that the 1.5 trillion pharmaceutical market is expected to usher in reconstruction.

In 2017, the new version of the medical insurance catalog added 339 drugs, including 17 new varieties in the central nervous system field and 21 new varieties.